Google's TPU Challenge to Nvidia: A Deep Dive into 2025-2026 Projections

TPU operations have arguably become one of Google’s most important revenue streams and will only grow in significance, potentially posing a major challenge to Nvidia’s market position.

We previously covered Amazon’s ASIC project in an earlier piece, updating readers on its latest developments. Today, we turn our attention to Google’s TPU (Tensor Processing Unit), which many consider the most significant threat to Nvidia’s dominance in AI computing.

In this piece, we’ll examine Google’s TPU shipments, revenue projections, and product mix for 2025, along with our outlook for 2026. We’ll also provide updates on the company’s V7 chip development.

This analysis is based on an expert interview with an industry insider from a company with substantial ASIC operations. Readers should note that this data is for reference purposes only. A key takeaway is that TPU operations have arguably become one of Google’s most important revenue streams and will only grow in significance, potentially posing a major challenge to Nvidia’s market position.

2025 Shipments, Revenue, and Product Mix

According to the expert source, Google’s TPU shipments are projected to reach 2.5 million units for the full year 2025. Through the third quarter of 2025, cumulative shipments have already reached 1.8 million units, representing 72% of the annual target.

Breaking down the quarterly distribution: Q1 shipments totaled approximately 500,000 units, providing a steady start to the year. Q2 saw modest growth to around 550,000 units, maintaining an upward trajectory. Q3 witnessed significant acceleration with 700,000-750,000 units shipped, coinciding with increased data center deployment activity in the second half. Q4 must deliver the remaining 700,000-800,000 units to meet the 2.5 million annual target.

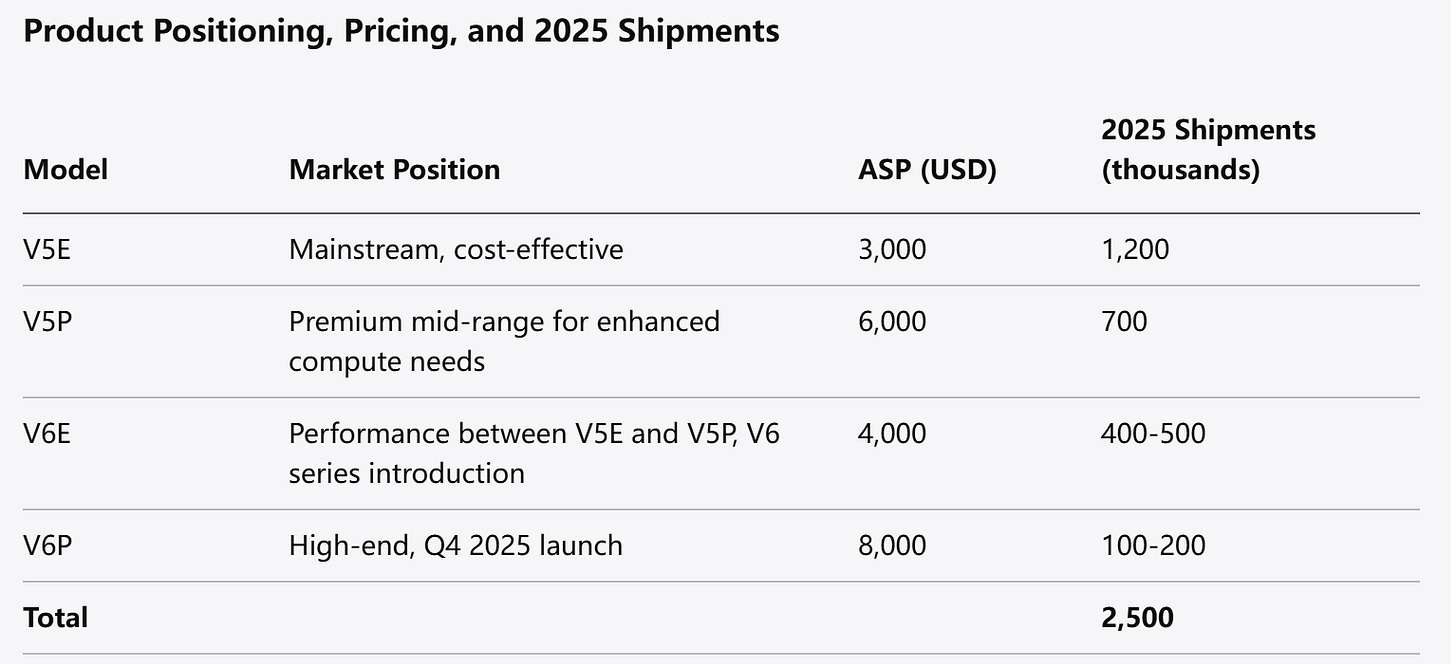

Within the 2.5 million total shipments for 2025, different models show distinct volume patterns. The TPU V5 series (encompassing V5E and V5P) serves as the current flagship product line, with projected shipments of 1.9 million units representing 76% of total volume. Specifically, V5E accounts for approximately 1.2 million units while V5P contributes around 700,000 units, reflecting a roughly 2:1 ratio that indicates stronger market demand for the mid-range V5E, likely due to its balanced performance and competitive pricing for most use cases.

The next-generation TPU V6 series (including V6E and V6P) is projected to ship 600,000 units, representing 24% of annual volume. Currently, only V6E is commercially available and handling the initial market introduction for this series. V6P is scheduled to launch in Q4, with initial production volumes expected to be relatively modest at 100,000-200,000 units due to production ramp-up constraints, with capacity scaling based on market feedback.

Based on shipment volumes and average selling prices, Google’s TPU-related revenue for 2025 is projected to reach $11.25 billion, calculated from 2.5 million units at an overall average selling price (ASP) of $4,500. This revenue scale demonstrates that TPU operations have become a significant income source for Google. However, due to various constraints including customer contract confidentiality, quarterly shipment timing variations across different SKUs, and internal financial reporting complexities, the expert cannot provide precise quarterly revenue breakdowns by individual customer or SKU.

Based on the 40% first-half, 60% second-half shipment distribution, the expert estimate first-half revenue at approximately $4.5 billion and second-half revenue at around $6.75 billion.

Seasonal Distribution Patterns

The 40%-60% split between first-half and second-half shipments reflects clear seasonal characteristics. First-half combined shipments total approximately 1.05 million units (500,000 + 550,000), while second-half volumes reach 1.45-1.55 million units (700,000-750,000 + 700,000-800,000), representing a 400,000-500,000 unit increase in the second half.

This seasonal pattern primarily stems from data center deployment cycles, as most enterprises and institutions concentrate their data center construction and upgrade activities in the second half to meet year-end IT infrastructure investment targets. This directly drives increased demand for core computing chips like TPUs, resulting in significantly higher Google TPU shipments in the latter half of the year.

Pricing Strategy by Model

Google TPU pricing varies by model based on performance specifications and technical complexity, with pricing strategy closely aligned to product positioning. The cost-effective V5E, targeting mainstream applications, carries an average price of approximately $3,000, providing strong competitiveness in scenarios requiring balanced performance and cost control. The premium V5P, offering enhanced performance, averages around $6,000—double the V5E price—primarily targeting mid-scale data centers and AI training workloads requiring higher computational capabilities.

The V6E, as the first V6 series product to market, offers performance between V5E and V5P at an average price of $4,000, balancing performance improvements with controlled cost increases. The upcoming Q4 launch V6P, representing the current high-end offering, is expected to command approximately $8,000, with pricing reflecting advanced manufacturing processes, higher computational density, and enhanced feature sets.

These prices may experience minor fluctuations based on TSMC manufacturing cost adjustments, but overall changes are expected to be limited to maintain market price stability.

For 2025, Google TPU’s overall ASP maintains around $4,500, representing a weighted average across V5 and V6 series models based on their respective shipment volumes and unit prices. The V5 series contributes high volume but lower unit prices, while the V6 series offers higher prices but lower volume, creating this balanced average.

2026 Outlook

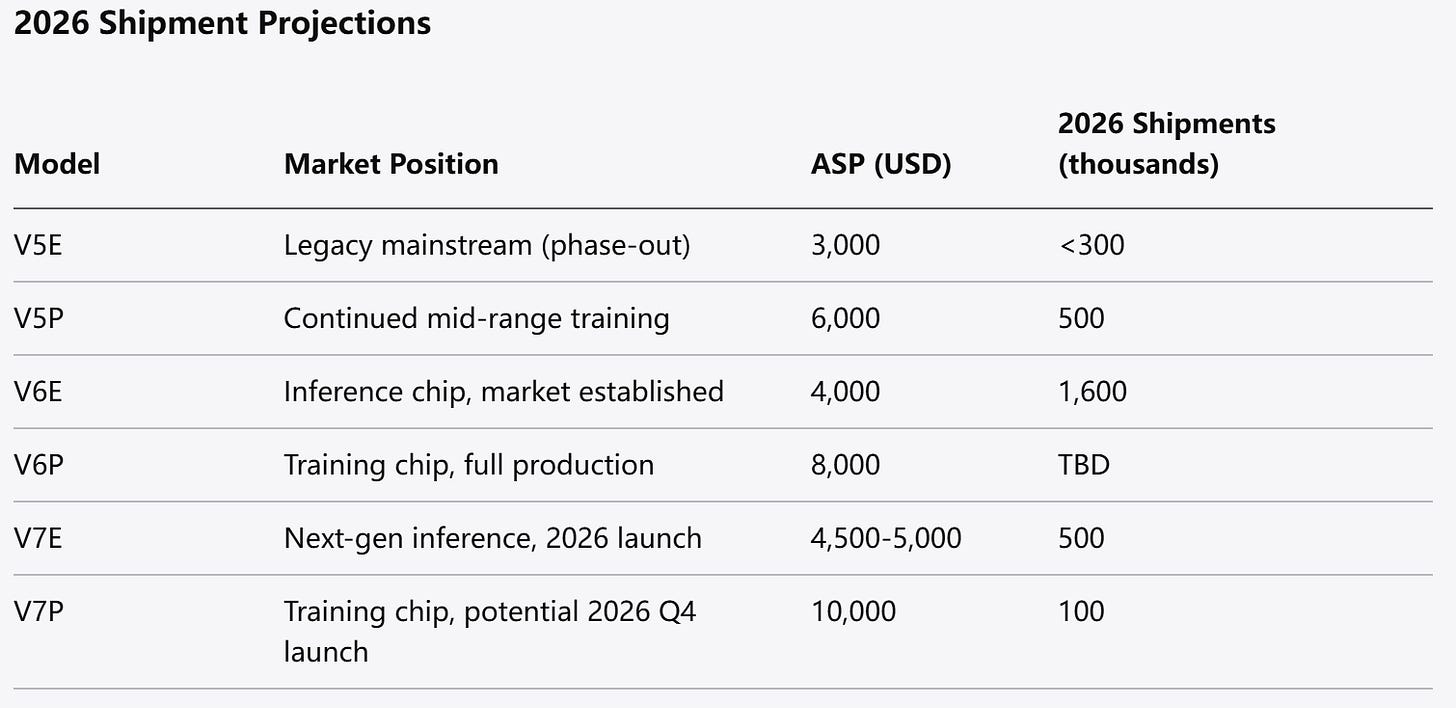

Looking ahead to 2026, Google TPU’s overall ASP is projected to remain between $4,500-5,000, without significant increases. This stability reflects two offsetting factors: while new TPU V7 series products may elevate average pricing, existing products like V6E will likely see price reductions as production scales and costs amortize. Additionally, from competitive and customer demand perspectives, excessive price increases could impact purchasing decisions, leading Google toward price stability. Overall, 2026 ASP increases will likely be controlled around 10%, maintaining relatively stable pricing trends.

The 2026 shipment landscape will show clear generational transition patterns. V5E volumes will not exceed 300,000 units as performance lags market requirements, with deployment limited to legacy server upgrades primarily in Q1-Q2 before gradual phase-out. Total V5 series shipments (V5E and V5P combined) are projected at 800,000 units, with V5P maintaining around 500,000 units due to continued relevance for mid-scale data center training requirements.

The V6 series is expected to become the volume leader with approximately 1.6 million total shipments in 2026. V6E will benefit from established market presence following 2025’s introduction, while V6P enters full production capacity after its Q4 2025 launch.

For the advanced V7 series, V7E shipments may approach 500,000 units as the series flagship targeting high-performance inference applications. V7P, if launched as scheduled in Q4, could reach up to 100,000 units, though potential delays due to development timelines, production ramp-up, or customer validation cycles could push the launch to 2027.

V7 Series Pricing Strategy

V7 series pricing (including V7E and future V7P) follows typical semiconductor lifecycle patterns of “high initial pricing, gradual reduction over time.” V7E will launch at $4,500-5,000, incorporating non-recurring engineering (NRE) cost recovery typically amortized across the first 100,000 units to rapidly recoup development investments. As initial volumes ship and production scales, with NRE costs fully amortized, V7E pricing is expected to decline to $3,000-4,000, consistent with previous V6E and V5E pricing evolution and reflecting industry-standard scale economy benefits.

The higher-specification V7P, due to significantly greater development costs and technical complexity (advanced manufacturing processes, higher computational capability, complex AI training task support), will command pricing near $10,000, also incorporating NRE recovery. V7P pricing may see minor adjustments based on market competition, customer feedback, and production capacity at launch, but the premium positioning will remain targeted at high-end data centers and large AI enterprise customers requiring ultimate performance.

thank you for sharing

To the best (educated) guess you can make, what is the breakeven ASP for an external buyer of TPU (take the v7 for example) once they've considered all the customization/re-architecting and re-adaption (moe layers, precision level adaptions etc)? Is there sufficient engineering talent around to help, say META, switch some of their MSA research to using TPUs? Just trying to get a sense of the real overall cost of buying TPUs...